BRIC

BRIC | |

|---|---|

| |

| Type | Foreign investment strategies grouping |

| Membership | |

| Establishment | |

• Term coined by Jim O'Neill | 2001 |

• Goldman Sachs closes BRIC fund | 2015 |

| Area | |

• Total | 38,464,219 km2 (14,851,118 sq mi) |

| Population | |

• 2022 estimate | 3,157,441,470 |

| GDP (PPP) | 2022 estimate |

• Total | $49.967 trillion |

| GDP (nominal) | 2022 estimate |

• Total | $27.107 trillion |

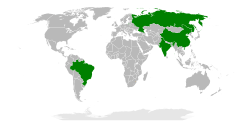

BRIC is a term describing the foreign investment strategies grouping acronym that stands for Brazil, Russia, India, and China. The separate BRICS organisation would go on to become a political and economic organization largely based on such grouping.[1] The grouping has been rendered as "the BRICs", "the BRIC countries", "the BRIC economies", or alternatively as the "Big Four".[2][3][4][5]

The term was first coined by economist Jim O'Neill and later championed by his employer Goldman Sachs in 2001. O'Neill identified the four countries as emerging markets and rising economic powers which were at a similar stage of newly advanced economic development. Goldman Sachs, of which O'Neill was the head of global economics research, would continue reporting and investing in their BRIC fund until 2015.[6] In a 2023 retrospective article, O'Neill commented that after the term's initial proposal, it gained an outsized popularilty in the 2000s and 2010s to explain the economic conditions of the four countries. He also conceded that the reports published by Goldman Sachs, which presented an optimistic possibility of the BRIC economies in the year 2050, were most likely not going to come true as economic downturns in the 2010s and early 2020s severely altered the trajectory of each country's economies.[7][8]

The acronym was co-opted by the countries themselves beginning in the late-2000s. The 1st BRIC summit in 2009, which founded the BRICS organisation, was held between the leaders of the four countries, with later summits involving South Africa beginning in 2010.[9][10] O'Neill commented on the 2010 summit by drawing a distinction between his BRIC term and the BRICS organisation, arguing that South Africa was too small as an economy to join the BRIC ranks.[11] In further comments in 2023, O'Neill stressed that he "never encouraged them to develop a political club" and that the organisation appeared to exist just as "a club that the US is not a part of."[12]

Reports

[edit]O'Neill's thesis (2001)

[edit]In 2001, Jim O'Neill, a global economist at Goldman Sachs at the time, proposed that the economic potential of Brazil, Russia, India and China is such that they could become among the most dominant economies by 2050.[13] At the time, these countries encompassed over 25% of the world's land coverage and 40% of the world's population and held a combined GDP (PPP) of $20 trillion. On almost every scale, they would be the largest entity on the global stage and were among the largest and fastest-growing emerging markets.{Incal 2011}

Politically, they have taken steps to increase their cooperation, mainly as a way of influencing the United States position on major trade accords, or, through the implicit threat of political cooperation, as a way of extracting political concessions from the United States, such as the proposed nuclear cooperation with India.[14][clarification needed]

"Dreaming with BRICS: The Path to 2050" (2003)

[edit]The BRIC thesis recognizes that Brazil, Russia, India and China have changed their political systems to embrace global capitalism.[15] Goldman Sachs predicts that China and India, respectively, will become the dominant global suppliers of manufactured goods and services, while Brazil and Russia will become similarly dominant as suppliers of raw materials. Of the four countries, Brazil remains the only polity that can continue all elements, meaning manufacturing, services, and resource supplying simultaneously. Cooperation is thus hypothesized to be a logical next step among the BRICs because Brazil and Russia together form the logical commodity suppliers.

In 2016, an Australian economist predicted that in 2050, China and India will be first and second respectively in terms of GDP per capita spending, surpassing the United States. Brazil was predicted to be in the fifth position. This was attributed due to the global economic center shifting from the Atlantic to the Asia Pacific region.[16]

Follow-up report (2004)

[edit]The economics team at Goldman Sachs released a follow-up report to its initial BRIC study in 2004.[17] The report states that in the BRIC nations, the number of people with an annual income over a threshold of $3,000 will double in number within three years and reach 800 million people within a decade. This predicted a massive rise in the size of the middle class in these nations. The report also includes calculations that in 2025, the number of people in BRIC nations earning over $15,000 would reach over 200 million people. This indicates that a huge pickup in demand will not be restricted to basic goods but impact higher-priced goods as well. According to the report, first China and then a decade later India would begin to dominate the world economy. However, it was noted that despite the balance of future growth swinging so decisively towards the BRIC economies, the average level of individuals in the more advanced economies will continue to far outstrip the BRIC economic average for the foreseeable future.[17]

The report also highlights India's inefficient energy consumption at the time as well as the dramatic under-representation of these economies in the global capital markets. The report also emphasizes the enormous populations that exist within the BRIC nations, which makes it relatively easy for their aggregate wealth to eclipse the G6, while per-capita income levels remained far below the norm of today's industrialized countries. This phenomenon, too, will affect world markets as multinational corporations will attempt to take advantage of the enormous potential markets in the BRIC countries. This would present itself in the automobile and other manufactured goods markets, as companies would produce far cheaper goods affordable to the consumers within the BRIC economies in lieu of the luxury models that may traditionally bring the most revenue. The report cites India and China as examples of countries which had already begun making their presence felt in the service and manufacturing sector respectively in the global arena, with developed economies already taking note of this.[17]

"India's Rising Growth Potential" (2007)

[edit]A second follow-up report was compiled by lead authors Tushar Poddar and Eva Yi in January 2007. The report unveiled updated projection figures attributed to the rising growth trends in India since 2003. Goldman Sachs asserts that "India's influence on the world economy will be bigger and quicker than implied in our previously published BRICs research". They noted significant areas of research and development and expansion that is happening in the country, which the report predicts would lead to the prosperity of the growing middle class. Demographically, India had 10 of the 30 fastest-growing urban areas in the world at the time. Based on trends at the time, an estimated 700 million Indians will move to cities by 2050. Such a demographic change would have significant implications for demand for urban infrastructure, real estate, and services.[18]

In the revised 2007 figures, based on increased and sustaining growth, more inflows into foreign direct investment, Goldman Sachs predicts that "from 2007 to 2020, India's GDP per capita in US$ terms will quadruple", and that the Indian economy will surpass the United States (in US$) by 2043. At the same time, the report indicated that Russia, while continuing its dominance of the European energy market, would continue to struggle economically, as its population declines.[18]

"EM Equity in Two Decades: A Changing Landscape" (2010)

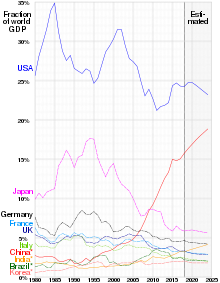

[edit]According to a 2010 report from Goldman Sachs, China might surpass the United States in equity market capitalization terms by 2030 and become the single largest equity market in the world.[19] By 2020, America's GDP might be only slightly larger than China's GDP. Together, the four BRICs may account for 41% of the world's market capitalization by 2030, the report said.[20]

Further developments

[edit]By 2015, Goldman Sachs quietly closed down its BRIC fund after lost 88 percent of its asset value since 2010, instead channeling the fund into emerging markets countries.[6] Jim O'Neill, the inventor of the term "BRIC", was the former chief economist of Goldman Sachs and retired from the firm in 2013.[21]

The head of emerging markets for Morgan Stanley Investment Management, Ruchir Sharma, released a book in 2012 entitled Breakout Nations. Sharma posited that such rapid growth for more than a decade is difficult to maintain, with outside commenters connecting this to the potential for the BRIC economies to slow their rapid economic rise.[6] This idea was partially accepted by O'Neill in 2023, who commented that in the time since the initial proposal of the BRIC term, the BRIC economies were unlikely to reach the 2050 projections published in the Goldman Sachs reported. O'Neill attributed this to post-2012 developments including government decisions and consequences from the Great Recession and impact of COVID-19 pandemic.[7][8]

In late 2010, China surpassed Japan's GDP for the first time, with China's GDP standing at $5.88 trillion compared to Japan's $5.47 trillion. China thus became the world's second-largest economy after the United States.[22] For the year 2013, for the first time China surpassed $4 trillion in world trade and become the world's largest trading country, consisting of $2.21 trillion in exports and $1.95 trillion in imports. While the United States for 11 months of 2013 world trade figure totaling $3.5 trillion and seems cannot beat China.[clarification needed] China's world trade balance in 2013 had a surplus of almost $260 billion, a 12.8% increased from the prior year.[23]

According to the National Institute of Economic and Social Research, based on International Monetary Fund figures, in 2012 Brazil became the sixth-largest economy in the world by overtaking United Kingdom with $2.52 trillion and $2.48 trillion, respectively. Comparatively in 2010, the Brazilian economy was worth $2.09 trillion while UK economy was worth $2.25 trillion. The significant increases were attributed to a Brazilian economic boom in high food and oil prices.[24] Since the beginning of the Great Recession, in Q3 2013 the economy of Brazil contracted by 0.5 percent compared with the previous quarter, being the first contraction since Q1 2009.[25]

In June 2012, following Standard & Poor's (S&P) report that India's growth outlook could deteriorate if policymaking and governance did not improve, Fitch Ratings cut its credit outlook for India from stable to negative while maintaining its BBB− rating, the lowest investment-grade rating. A week before Fitch released the rating, S&P stated that India could become the first of the BRIC countries to lose investment-grade status.[26]

Based on a March 2011 Forbes report, the BRIC countries counted 301 billionaires among their combined populations, exceeding the number of billionaires in Europe, which stood at 300 in 2011.[27]

Statistics

[edit]

A Goldman Sachs paper published in December 2005 explained why Mexico was not included in the original BRICs.[3] The Economist publishes an annual table of socio-economic national statistics in its "Pocket World in Figures".[citation needed] Extrapolating the global rankings from their 2008 Edition for the BRIC countries and economies in relation to various categories provides an interesting touchstone in relation to the economic underpinnings of the BRIC thesis. It also illustrates how, despite their divergent economic bases, the economic indicators are remarkably similar in global rankings between the different economies. It also suggests that, while economic arguments can be made for linking Mexico into the BRIC thesis, the case for including South Korea looks considerably weaker.

General statistics

[edit]| Categories | Brazil | Russia | India | China |

|---|---|---|---|---|

| Area | 5th | 1st | 7th | 3rd |

| Population | 5th | 9th | 1st | 2nd |

| Population growth rate | 128th | 177th | 98th | 148th |

| Labor force | 5th | 6th | 2nd | 1st |

| GDP (nominal) | 8th | 10th | 5th | 2nd |

| GDP (PPP) | 7th | 6th | 3rd | 1st |

| GDP (nominal) per capita | 57th | 47th | 139th | 72nd |

| GDP (PPP) per capita | 75th | 55th | 126th | 72nd |

| GDP (real) growth rate | 180th | 177th | 3rd | 12th |

| Human Development Index | 85th | 55th | 114th | 79th |

| Exports | 6th | 8th | 12th | 1st |

| Imports | 21st | 17th | 8th | 2nd |

| Current account balance | 187th | 5th | 186th | 2nd |

| Received FDI | 13th | 16th | 19th | 4th |

| Foreign exchange reserves | 10th | 6th | 9th | 1st |

| External debt | 20th | 21st | 22nd | 12th |

| Public debt | 42nd | 190th | 104th | 184th |

| Electricity consumption | 9th | 4th | 3rd | 1st |

| Renewable energy source | 3rd | 5th | 6th | 1st |

| Number of mobile phones | 4th | 5th | 2nd | 1st |

| Number of internet users | 5th | 6th | 2nd | 1st |

| Motor vehicle production | 9th | 15th | 5th | 1st |

| Military expenditures | 11th | 4th | 5th | 2nd |

| Active troops | 15th | 5th | 2nd | 1st |

| UN Peacekeepers | 24th | 77th | 3rd | 9th |

| Rail network | 10th | 3rd | 4th | 2nd |

| Road network | 4th | 7th | 2nd | 3rd |

Goldman Sachs prediction

[edit]

| Rank 2050 | Country | 2050 | 2045 | 2040 | 2035 | 2030 | 2030 USDA[30] | 2025 | 2020 | 2015 | 2010 | 2006 | Percent increase from 2006 to 2050 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | China | 70,710 | 57,310 | 45,022 | 34,348 | 25,610 | 22,200 | 18,437 | 12,630 | 8,133 | 4,667 | 2,682 | 2536% |

| 2 | India | 38,668 | 25,278 | 16,510 | 10,514 | 6,683 | 6,600 | 4,316 | 2,848 | 1,900 | 1,256 | 909 | 4043% |

| 3 | United States | 38,514 | 33,904 | 29,823 | 26,097 | 22,817 | 24,800 | 20,087 | 17,978 | 16,194 | 14,535 | 13,245 | 190% |

| 4 | Brazil | 11,366 | 8,740 | 6,631 | 4,963 | 3,720 | 4,000 | 2,831 | 2,194 | 1,720 | 2,087 | 1,064 | 968% |

| 5 | Mexico | 9,340 | 7,204 | 5,471 | 4,102 | 3,068 | 2,300 | 2,303 | 1,742 | 1,327 | 1,009 | 851 | 997% |

| 6 | Russia | 8,580 | 7,420 | 6,320 | 5,265 | 4,265 | 2,400 | 3,341 | 2,554 | 1,900 | 1,371 | 982 | 773% |

Note: All data above is from Goldman Sachs, except the 2030 USDA column is data from U.S. Department of Agriculture (2030 USDA) about World's 20 Largest Economies in 2030, but only 16 match with Goldman Sachs data. In 2030 USDA, Mexico and Indonesia will topple South Korea (please see Section Proposed inclusions). There is no South Africa of BRIC S in the above table. In 2030, the sole country from Africa is Nigeria and the US is still number one, but China almost overtakes the US.

| Rank 2050 | Country | 2050 | 2045 | 2040 | 2035 | 2030 | 2025 | 2020 | 2015 | 2010 | 2006 | Percent increase from 2006 to 2050 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | United States | 91,683 | 83,489 | 76,044 | 69,019 | 62,717 | 57,446 | 53,502 | 50,200 | 47,014 | 44,379 | 106% |

| 2 | South Korea | 90,294 | 75,979 | 63,924 | 53,449 | 44,602 | 36,813 | 29,868 | 26,012 | 21,602 | 18,161 | 397% |

| 3 | United Kingdom | 79,234 | 73,807 | 67,391 | 61,049 | 55,904 | 52,220 | 49,173 | 45,591 | 41,543 | 38,108 | 107% |

| 4 | Russia | 78,435 | 65,708 | 54,221 | 43,800 | 34,368 | 26,061 | 19,311 | 13,971 | 9,833 | 6,909 | 1,037% |

| 5 | Canada | 76,002 | 69,531 | 63,464 | 57,728 | 52,663 | 48,621 | 45,961 | 43,449 | 40,541 | 38,071 | 99% |

| 6 | France | 75,253 | 68,252 | 62,136 | 56,562 | 52,327 | 48,429 | 44,811 | 41,332 | 38,380 | 36,045 | 108% |

| 7 | Germany | 68,253 | 62,658 | 57,118 | 51,710 | 47,263 | 45,033 | 43,223 | 40,589 | 37,474 | 34,588 | 97% |

| 8 | Japan | 66,846 | 60,492 | 55,756 | 52,345 | 49,975 | 46,419 | 42,385 | 38,650 | 36,194 | 34,021 | 96% |

| 9 | Mexico | 63,149 | 49,393 | 38,255 | 29,417 | 22,694 | 17,685 | 13,979 | 11,176 | 8,972 | 7,918 | 697% |

| 10 | Italy | 58,545 | 52,760 | 48,070 | 44,948 | 43,195 | 41,358 | 38,990 | 35,908 | 32,948 | 31,123 | 88% |

| 11 | Brazil | 49,759 | 38,149 | 29,026 | 21,924 | 16,694 | 12,996 | 10,375 | 8,427 | 6,882 | 5,657 | 779% |

| 12 | China | 49,650 | 39,719 | 30,951 | 23,511 | 17,522 | 12,688 | 8,829 | 5,837 | 3,463 | 2,041 | 2,332% |

| 13 | Turkey | 45,595 | 34,971 | 26,602 | 20,046 | 15,188 | 11,743 | 9,291 | 7,460 | 6,005 | 5,545 | 722% |

| 14 | Vietnam | 33,472 | 23,932 | 16,623 | 11,148 | 7,245 | 4,583 | 2,834 | 1,707 | 1,001 | 655 | 5,010% |

| 15 | Iran | 32,676 | 26,231 | 20,746 | 15,979 | 12,139 | 9,328 | 7,345 | 5,888 | 4,652 | 3,768 | 767% |

| 16 | Indonesia | 22,395 | 15,642 | 10,784 | 7,365 | 5,123 | 3,711 | 2,813 | 2,197 | 1,724 | 1,508 | 1,385% |

| 17 | India | 20,836 | 14,446 | 9,802 | 6,524 | 4,360 | 2,979 | 2,091 | 1,492 | 1,061 | 817 | 2,450% |

| 18 | Pakistan | 20,500 | 14,025 | 9,443 | 6,287 | 4,287 | 3,080 | 2,352 | 1,880 | 1,531 | 1,281 | 1,500% |

| 19 | Philippines | 20,388 | 14,260 | 9,815 | 6,678 | 4,635 | 3,372 | 2,591 | 2,075 | 1,688 | 1,312 | 1,453% |

| 20 | Nigeria | 13,014 | 8,934 | 6,117 | 4,191 | 2,944 | 2,161 | 1,665 | 1,332 | 1,087 | 919 | 1,316% |

| 21 | Egypt | 11,786 | 7,066 | 5,183 | 3,775 | 2,744 | 2,035 | 1,568 | 1,260 | 897 | 778 | 808% |

| 22 | Bangladesh | 5,235 | 3,767 | 2,698 | 1,917 | 1,384 | 1,027 | 790 | 627 | 510 | 427 | 1,125% |

| Groups | Countries | 2050 | 2045 | 2040 | 2035 | 2030 | 2025 | 2020 | 2015 | 2010 | 2006 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BRICS | Brazil, Russia, India, China, South Africa | 128,324 | 98,757 | 74,483 | 55,090 | 40,278 | 28,925 | 20,226 | 13,653 | 8,640 | 5,637 |

| G7 | Canada, France, Germany, Italy, Japan, United Kingdom, US | 66,039 | 59,475 | 53,617 | 48,281 | 43,745 | 39,858 | 36,781 | 33,414 | 30,437 | 28,005 |

The following three tables are lists of economies by incremental GDP from 2006 to 2050 by Goldman Sachs. They illustrate that the BRICs and N11 nations are replacing G7 nations as the main contributors to the world's economic growth. From 2020 to 2050, nine of the ten largest countries by incremental GDP are occupied by the BRICs and N11 nations, in which the United States remains to be the only G7 member as one of the three biggest contributors to the global economic growth.[29]

|

|

|

At the World Economic Forum 2011, there were 365 corporate executives from BRIC and other emerging nations out of 1000 participants. It was a record number of executives from emerging markets. Nomura Holdings Inc's co-head of global investment banking said that "It's a reflection of where economic power and influence is starting to move." The International Monetary Fund estimated emerging markets might expand 6.5 percent in 2011, more than double the 2.5 percent rate for developed countries. BRIC's takeover made record by 22 percent of global deals or increase by 74 percent in one year and more than quadrupled in the last five years.[31]

According to The World Bank Doing Business report 2019 the BRIC economies introduced a total of 21 reforms, with getting electricity and trading across borders the most common areas of improvement.[32]

History

[edit]Organisation

[edit]

Various sources[which?] refer to a purported "original" BRIC agreement that predates the Goldman Sachs thesis. Some of these sources claim that President Vladimir Putin of Russia was the driving force behind this original cooperative coalition of developing BRIC countries. However, thus far, no text has been made public of any formal agreement to which all four BRIC states are signatories.[citation needed] This does not mean, however, that they have not reached a multitude of bilateral or even quadrilateral agreements. Evidence of agreements of this type are abundant and are available on the foreign ministry websites of each of the four countries.[relevant?] Trilateral agreements and frameworks made among the BRICs include the Shanghai Cooperation Organisation (member states include Russia and China, observers include India) and the IBSA Trilateral Forum, which unites Brazil, India, and South Africa in annual dialogues. The Russia-India-China (RIC) strategic triangle was envisaged by Russian prime minister Yevgeny Primakov in the 1990s. The G20 forum of developing states includes all the BRIC countries.

South Africa sought BRIC membership since 2009 and the process for formal admission began as early as August 2010.[33] South Africa was officially admitted as a BRIC nation on 24 December 2010, after being invited by China and the other BRIC countries to join the group.[34] The capital "S" in BRICS stands for South Africa. President Jacob Zuma attend the BRICS summit in Sanya in April 2011 as a full member. South Africa stands at a unique position to influence African economic growth and investment. According to Jim O'Neill of Goldman Sachs who originally coined the term, Africa's combined current gross domestic product is reasonably similar to that of Brazil and Russia, and slightly above that of India.[35] South Africa is a "gateway" to Southern Africa and Africa in general as the most developed African country.[35] China is South Africa's largest trading partner, and India wants to increase commercial ties with Africa.[10] South Africa is also Africa's largest economy, but as number 31 in global GDP economies it is far behind its new partners.[10]

Jim O'Neill expressed surprise when South Africa joined BRIC since South Africa's economy is a quarter of the size of Russia's (the least economically powerful BRIC nation).[36] He believed that the potential was there but did not anticipate inclusion of South Africa at this stage.[35] Martyn Davies, a South African emerging markets expert, argued that the decision to invite South Africa made little commercial sense but was politically astute given China's attempts to establish a foothold in Africa. Further, South Africa's inclusion in BRICS may translate to greater South African support for China in global fora.[36] He has great belief that the "S" in "BRICS" could be replaced eventually by SADC.

African credentials are important geopolitically, giving BRICS a four-continent breadth, influence and trade opportunities.[10] South Africa's addition is a deft political move that further enhances BRICS' power and status.[10] In the original essay that coined the term, Goldman Sachs did not argue that the BRICs would organize themselves into an economic bloc, or a formal trading association which this move signifies.[citation needed]

Marketing

[edit]This section needs additional citations for verification. (October 2024) |

The BRIC term is also used by companies[which?] who refer to the four named countries as key to their emerging markets strategies. By comparison, the reduced acronym IC would not be attractive, although the term "Chindia" is often used. BRIC's study specifically focuses on large countries, not necessarily the wealthiest or the most productive and was never intended to be an investment thesis. If investors read Goldman's research carefully and agreed with the conclusions, then they would gain exposure to Asian debt and equity markets rather than to Latin America. According to estimates provided by the USDA, the wealthiest regions outside of the G6 in 2015 will be Hong Kong, South Korea and Singapore. Combined with China and India, these five economies are likely to be the world's five most influential economies outside of the G6.[citation needed]

On the other hand, when the "R" in BRIC is extended beyond Russia and is used as a loose term to include all of Eastern Europe as well, then the BRIC story becomes more compelling. At issue are the multiple serious problems which confront Russia (potentially unstable government, environmental degradation, critical lack of modern infrastructure, etc.), and the comparatively much lower growth rate seen in Brazil. However, Brazil's lower growth rate obscures the fact that the country is wealthier than China or India on a per-capita basis, has a more developed and global integrated financial system and has an economy potentially more diverse than the other BRICs due to its raw material and manufacturing potential. Many other Eastern European countries, such as Poland, Romania, the Czech Republic, Slovakia, Hungary, Bulgaria, and several others were able to continually sustain high economic growth rates and do not experience some of the problems that Russia experiences or experience them to a lesser extent. In terms of GDP per capita in 2008, Brazil ranked 64th, Russia 42nd, India 113th, and China 89th. By comparison, South Korea ranked 24th and Singapore 3rd.[citation needed]

Brazil's stock market, the Bovespa, has gone from approximately 9,000 in September 2002 to over 70,000 in May 2008. Government policies have favored investment (lowering interest rates), retiring foreign debt and expanding growth, and a reformulation of the tax system is being voted in the congress. The British author and researcher Mark Kobayashi-Hillary wrote a book in 2007, along with contributors Nandan Nilekani and Shiv Nada, titled Building a Future with BRICs for European publisher Springer Verlag that examines the growth of the BRICs region and its effect on global sourcing.[citation needed]

International law

[edit]Brazilian lawyer and author Adler Martins has published a paper called "Contratos Internacionais entre os países do BRIC" (International Agreements Among BRIC countries) which highlights the international conventions ratified by the BRIC countries, which allow them to maintain trade and investment activities safely within the group. Martin's study is being further developed by the Federal University of the Minas Gerais State, in Brazil.[38]

Financial diversification

[edit]Some observers have argued that geographic diversification would eventually generate superior risk-adjusted returns for long-term global investors by reducing overall portfolio risk while capturing some of the higher rates of return offered by the emerging markets of Asia, Eastern Europe and Latin America.[39] By doing so, these institutional investors have contributed to the financial and economic development of key emerging nations such as Brazil, India, China, and Russia. For global investors, India and China constitute both large-scale production platforms and reservoirs of new consumers, whereas Russia is viewed essentially as an exporter of oil and commodities- Brazil and Latin America being somehow "in the middle".[citation needed]

Criticism

[edit]Academics and experts have suggested that China is in a league of its own compared to the other BRIC countries.[40] As David Rothkopf wrote in Foreign Policy, "Without China, the BRICs are just the BRI, a bland, soft cheese that is primarily known for the whine [sic] that goes with it. China is the muscle of the group and the Chinese know it. They have effective veto power over any BRIC initiatives because without them, who cares really? They are the one with the big reserves. They are the biggest potential market. They are the U.S. partner in the G2 (imagine the coverage a G2 meeting gets vs. a G8 meeting) and the E2 (no climate deal without them) and so on."[41] Deutsche Bank Research stated in a report that "economically, financially and politically, China overshadows and will continue to overshadow the other BRICs". It added that China's economy is larger than that of the three other BRIC economies (Brazil, Russia, and India) combined. Moreover, China's exports and its official foreign-exchange reserves are more than twice as large as those of the other BRICs combined.[42] In that perspective, some pension investment experts have argued that "China alone accounts for more than 70% of the combined GDP growth generated by the BRIC countries [from 1999 to 2010]: if there is a BRIC miracle it's first and foremost a Chinese one".[43] The "growth gap" between China and other large emerging economies such as Brazil, Russia and India can be attributed to a large extent to China's early focus on ambitious infrastructure projects: while China invested roughly 9% of its GDP on infrastructure in the 1990s and 2000s, most emerging economies invested only 2% to 5% of their GDP. This considerable spending gap allowed the Chinese economy to grow at near-optimal conditions while many South American and South Asian economies suffered from various development bottlenecks (poor transportation, aging power grids, mediocre schools).[44] In 2024, Jim O'Neill himself, when referring to the BRICS organisation, said that "without the Chinese presence, I don't think there would be much real importance, at all, to the BRICS group" due to the country's influence and power relative to other members.[45]

Other critics[who?] suggest that BRIC is nothing more than a neat acronym for the four largest emerging market economies, but in economic and political terms nothing else links the four (apart from the fact that they are all big emerging markets).[citation needed] While China and India are manufacturing-based economies and rely on imports, Brazil and Russia are large exporters of natural resources.[citation needed] The Economist, in a special report on Brazil, expressed the following view: "In some ways, Brazil is the steadiest of the BRICs. Unlike China and Russia, it is a full-blooded democracy; unlike India, it has no serious disputes with its neighbors. It is the only BRIC without a nuclear bomb".[citation needed] The Heritage Foundation's Indices of Economic Freedom, which measures factors such as protection of property rights and free trade ranks Brazil "moderately free" above the other BRICs, which are ranked as "mostly unfree".[46] Henry Kissinger has stated that the BRIC nations have no hope of acting together as a coherent bloc in world affairs and that any cooperation will be the result of forces acting on the individual nations.[citation needed]

In a not-so-subtle dig critical of the term as nothing more than a shorthand for emerging markets generally, critics have suggested a correlating term, CEMENT (Countries in Emerging Markets Excluded by New Terminology). Whilst they accept there has been spectacular growth of the BRIC economies, these gains have largely been the result of the strength of emerging markets generally, and that strength comes through having BRICs and CEMENT.[47]

Based on IMF's World Economic Outlook Database, published in October 2016, the top economies in 2021 (by projected nominal gross domestic product (GDP)) are projected to be, in order, China, United States, India, Japan, Germany, Russia, Indonesia, Brazil, the U.K., and France.[48]

Proposed inclusions

[edit]Mexico and South Korea are currently the world's 13th and 15th largest by nominal GDP just behind the BRIC and G7 economies. Both are experiencing rapid GDP growth of 5% every year, a figure comparable to Brazil from the original BRICs. Jim O'Neill, creator of the economic thesis, stated that in 2001 when the paper was created, it did not consider Mexico, but today it has been included because the country is experiencing the same factors that the other countries first included present.[49][50] While South Korea was not originally included in the BRICs, recent solid economic growth led to Goldman Sachs proposing to add Mexico and South Korea to the BRICs, changing the acronym to BRIMCK, with Jim O'Neill pointing out that Korea "is better placed than most others to realize its potential due to its growth-supportive fundamentals".[51]

A Goldman Sachs paper published later in December 2005 explained why Mexico and South Korea were not included in the original BRICs. According to the paper,[3] among the other countries they looked at, only Mexico and South Korea have the potential to rival the BRICs, but they are economies that they decided to exclude initially because they looked to them as already more developed. However, due to the popularity of the Goldman Sachs thesis, "BRIMC" and "BRICK" are becoming more generic marketing terms to refer to these six countries. Because of the popularity of the Goldman Sachs thesis "BRIC", this term has sometimes been extended whereby "BRICK"[52][53] (K for South Korea) and "BRIMC"[49][50] (M for Mexico) refer to these proposed expansions. Other proposed groupings include "BRICA" (GCC Arab countries—Saudi Arabia, Qatar, Kuwait, Bahrain, Oman and the United Arab Emirates)[54] and "BRICET" (including Eastern Europe and Turkey)[55] and have become more generic marketing terms to refer to these emerging markets.

In an August 2010 op-ed, Jim O'Neill of Goldman Sachs argued that Africa could be considered the next BRIC.[56] Analysts from rival banks have sought to move beyond the BRIC concept, by introducing their own groupings of emerging markets. Proposals include CIVETs (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa), the EAGLES (Emerging and Growth-Leading Economies) and the 7 percent club (which includes those countries which have averaged economic growth of at least 7 percent a year).[57]

In their paper "BRICs and Beyond", Goldman Sachs stated that "Mexico, the four BRIC countries and South Korea should not be really thought of as emerging markets in the classical sense", adding that they are a "critical part of the modern globalised economy" and "just as central to its functioning as the current G7".[58]

The term is primarily used in the economic and financial spheres as well as in academia. Its usage has grown specially in the investment sector, where it is used to refer to the bonds emitted by these emerging markets governments.[59][60][61]

O'Neill would later coin several other terms for groupings of emerging economies at various stages. First, the term "The Next Eleven" referred to Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey, and Vietnam, arguing they would be among the world's largest economies in the 21st century.[62][63] O'Neill next used the term MIKT for Mexico, Indonesia, South Korea, and Turkey.[64][65] MINT was another acronym coined by O'Neill standing for Mexico, Indonesia, Nigeria, and Turkey.[66]

Mexico

[edit]

Primarily, along with the BRICs,[67] Goldman Sachs argues that the economic potential of Brazil, Russia, India, Mexico and China is such that they may become (with the United States) the six most dominant economies by 2050. Due to Mexico's rapidly advancing infrastructure, increasing middle class and rapidly declining poverty rates it is expected to have a higher GDP per capita than all but three European countries by 2050, this newfound local wealth also contributes to the nation's economy by creating a large domestic consumer market which in turn creates more jobs.

| GDP in USD | $9.340 trillion |

| GDP per capita | $63,149 |

| GDP growth (2015–2050) | 4.0% |

| Total population | 142 million |

South Korea

[edit]South Korea is one of the world's most highly developed countries and including it with developing countries like the BRICs is not deemed correct.[by whom?] However, commentators such as William Pesek from Bloomberg argue that Korea is "Another 'BRIC' in Global Wall", suggesting that it stands out from the Next Eleven economies with its BRIC-like growth rate, despite its Human Development Index being higher than some of the world's most advanced economies, including France, United Kingdom, Austria, Denmark, Finland and Belgium. South Korean workers are the wealthiest among major Asian countries, with a higher income than Japan and the strongest growth rate in the OECD. More importantly, it has a significantly higher Growth Environment Score (Goldman Sachs' way of measuring the long-term sustainability of growth) than all of the BRICs or N-11s.[58] According to the IMF, South Korea's GDP measured by purchasing power parity is already larger than Canada and Spain.[citation needed] In terms of GDP per capita (PPP), South Korea overtook Spain in 2010.[citation needed] According to Citibank, South Korea will continue by overtaking Germany, Britain, Australia and Sweden by 2020, surpassing Canada, Switzerland, Netherlands and Norway by 2030 and taking over the United States by 2040 to become the world's wealthiest major economy. While measuring the South Korean economy by nominal GDP is inaccurate as the South Korean won is artificially kept low to boost exports, the IMF predicted South Korea's nominal GDP and GDP per capita will surpass Spain in 2015.[citation needed] Economists from other investment firms argue that even when measured by nominal GDP per capita, South Korea will achieve over $145,000 in 2040, surpassing the United States, suggesting that wealth is more important than size for bond investors, stating that Korea's credit rating will be rated AAA sooner than 2050.[69]

United Korea

[edit]In September 2009, Goldman Sachs published its 188th Global Economics Paper named "A United Korea?" which highlighted in detail the potential economic power of a United Korea, which would surpass all current G7 countries except the United States and Japan within 30–40 years of reunification, estimating GDP to surpass $6 trillion by 2050.[70] The young, skilled labor and large amount of natural resources from the North combined with advanced technology, infrastructure and large amount of capital in the South, as well as Korea's strategic location connecting three economic powers, would likely create an economy larger than the bulk of the G7. A reunited Korea could occur sometime before 2050 according to some outside observers.[71]

| GDP in USD | $6.056 trillion | $4.073 trillion | $1.982 trillion |

| GDP per capita | $86,000 | $96,000 | $70,000 |

| GDP growth (2015–2050) | 4.8% | 3.9% | 11.4% |

| Total population | 71 million | 42 million | 28 million |

See also

[edit]- CIVETS, a similar economics term coined in 2009 for six other emerging economies

- Potential superpower

- List of country groupings

References

[edit]- ^ "New era as South Africa joins BRICS". SouthAfrica.info. Archived from the original on 18 April 2011. Retrieved 19 June 2012.

- ^ O'Neill, Jim (30 November 2001). Building Better Global Economic BRICs, Global Economics Paper No: 66 (PDF). Goldman Sachs.

- ^ a b c O'Neill, Jim; Dominic Wilson; Roopa Purushothaman; Anna Stupnytska (1 December 2005). How Solid are the BRICs? Global Economics Paper No: 134 (PDF). Goldman Sachs. Retrieved 27 March 2024.

- ^ Dominic Wilson, Roopa Purushothaman (1 October 2003). Dreaming with BRICs. Global Economics Paper No. 99. Goldman Sachs.

- ^ "Another BRIC in the wall". The Economist. 21 April 2008. Archived from the original on 9 February 2015. Retrieved 28 July 2014.

- ^ a b c Rana Foroohar (10 November 2015). "Why the Mighty BRIC Nations Have Finally Broken". Archived from the original on 20 December 2016. Retrieved 6 December 2016.

- ^ a b "The future of the BRICS and the New Development Bank | Global Policy Journal". www.globalpolicyjournal.com. Retrieved 23 October 2024.

- ^ a b Jim O'Neill, Lord O'Neill of Gatley (2024). "The future of the BRICS and the New Development Bank". Policy Insights. 15 (2): 383–388. doi:10.1111/1758-5899.13195.

- ^ Halpin, Tony, "Brazil, Russia, India and China form bloc to challenge US dominance" Archived 2 September 2011 at the Wayback Machine, The Times, 17 June 2009.

- ^ a b c d e Graceffo, Antonio (21 January 2011). "BRIC Becomes BRICS: Changes on the Geopolitical hessboard". Foreign Policy Journal. Archived from the original on 26 January 2011. Retrieved 14 April 2011.

- ^ Reuters 2011 Investment Outlook Summit, London and New York, 6–7 December 2010

- ^ "Lord Jim O'Neill: 'I never intended for BRICs to become a political club'". ETF Stream. 14 November 2023. Retrieved 23 October 2024.

- ^ "Ask the expert: BRICs and investor strategy". Financial Times. 6 November 2006. Archived from the original on 25 April 2015. Retrieved 28 July 2014.

- ^ Lok-sang Ho, John Wong (2011). Apec and the Rise of China. World Scientific. p. 118.

- ^ Farah, Paolo D. (2006). "Five Years of China's WTO Membership: EU and US Perspectives on China's Compliance with Transparency Commitments and the Transitional Review Mechanism" (PDF). Legal Issues of Economic Integration. 33 (3): 263–304. doi:10.54648/LEIE2006016. S2CID 153128973. Archived (PDF) from the original on 14 August 2014. Retrieved 28 July 2014.

- ^ Chandra Hamdani Noer (22 October 2016). "Indonesia the Fourth-Largest in GDP in 2050: Analysts". Archived from the original on 24 October 2016. Retrieved 24 October 2016.

- ^ a b c BRICs Archived 27 February 2008 at the Wayback Machine – Goldman Sachs Research Report

- ^ a b Podar, Tushar; Yi, Eva (22 January 2007). "India's Rising Growth Potential" (PDF). GS Global Economic website. Global Economics Paper No. 15 2. Archived (PDF) from the original on 29 July 2014. Retrieved 22 July 2014.

- ^ Timothy Moe; Caesar Maasry; Richard Tang (8 September 2010). EM Equity in Two Decades: A Changing Landscape (Global Economics Paper No: 204) (PDF). Goldman Sachs. Archived from the original (PDF) on 8 July 2011.

- ^ "Goldman predicts: onwards and upwards for emerging markets". Blogs.ft.com. 8 September 2010. Archived from the original on 28 June 2012. Retrieved 19 June 2012.

- ^ Blankfein, Lloyd C.; Cohn, Gary D. (5 February 2013). "Jim O'Neill to retire from Goldman Sachs" (Press release). Goldman Sachs. Archived from the original on 8 February 2013. Retrieved 14 March 2013.

- ^ Tabuchi, Hiroko (14 February 2011). "China Replaced Japan in 2010 as No. 2 Economy". The New York Times. Archived from the original on 28 February 2017. Retrieved 24 February 2017.

- ^ Angela Monaghan (10 January 2014). "China surpasses US as world's largest trading nation". The Guardian. Archived from the original on 3 January 2017. Retrieved 11 December 2016.

- ^ "Brazil 'overtakes UK's economy'". BBC News. 6 March 2012. Archived from the original on 10 July 2018. Retrieved 20 June 2018.

- ^ "Brazil's economy experiences first contraction since 2009". Fox News. 4 December 2013. Archived from the original on 9 August 2014.

- ^ "Fitch cuts India rating outlook to negative". Reuters. 18 June 2012. Archived from the original on 19 June 2012. Retrieved 19 June 2012.

- ^ Rappeport, Alan (9 March 2011). "Brics becoming billionaire factory". Financial Times.

- ^ "IMF World Economic Outlook database". Retrieved 28 January 2020.

- ^ a b c d e "BRICS and Beyond" Archived 3 December 2011 at the Wayback Machine – Goldman Sachs study of BRIC and N11 nations, 23 November 2007.

- ^ Jeanna Smialek (10 April 2015). "These Will Be the World's 20 Largest Economies in 2030". Bloomberg News. Archived from the original on 19 November 2016. Retrieved 5 March 2017.

- ^ "Your Playlist is currently empty". Bloomberg.[dead link]

- ^ "Doing Business 2019".

- ^ "BRIC Becomes BRICS: Changes on the Geopolitical Chessboard". Foreign Policy Journal. 21 January 2011. Archived from the original on 26 January 2011. Retrieved 19 June 2012.

- ^ "BRIC Becomes BRICS: Changes on the Geopolitical Chessboard". Foreign Policy Journal. 21 January 2011. Archived from the original on 3 June 2012. Retrieved 19 June 2012.

- ^ a b c Jim O'Neill (economist) (26 August 2010). "How Africa can become the next Bric". Financial Times. Archived from the original on 31 October 2012. Retrieved 19 June 2012.

- ^ a b "South Africa | Economy | BRIC". Global Post. 8 January 2011. Archived from the original on 3 April 2012. Retrieved 19 June 2012.

- ^ "DealTalk: Nasdaq, CBOE top targets in exchange merger mania" Archived 24 September 2015 at the Wayback Machine, Reuters, 10 February 2011.

- ^ MARTINS, Adler. Available at https://jus.com.br/artigos/17419/contratos-internacionais-entre-os-paises-do-bric

- ^ see M. Nicolas J. Firzli, Asia-Pacific Funds as Diversification Tools for Institutional Investors (PDF) (in French), archived from the original (PDF) on 8 May 2010, retrieved 2 April 2009

- ^ "BRICs and G-2". Indianexpress.com. 17 June 2009. Archived from the original on 21 July 2009. Retrieved 15 October 2010.

- ^ "What BRIC would be without China... | David Rothkopf". Rothkopf.foreignpolicy.com. Archived from the original on 11 July 2011. Retrieved 15 October 2010.

- ^ "The Hindu News Update Service". Chennai, India: Hindu.com. 8 June 2009. Archived from the original on 4 June 2011. Retrieved 15 October 2010.

- ^ see M. Nicolas J. Firzli, "Forecasting the Future: The G7, the BRICs and the China Model", JTW & An-Nahar, 9 March 2011, archived from the original on 14 March 2011, retrieved 9 March 2011

- ^ M. Nicolas Firzli & Vincent Bazi (2011). "Infrastructure Investments in an Age of Austerity: The Pension and Sovereign Funds Perspective". Revue Analyse Financière, volume 41. Archived from the original on 17 September 2011. Retrieved 30 July 2011.

- ^ "Jim O'Neill stresses promoting trade, combating global challenges for future BRICS cooperation - People's Daily Online". en.people.cn. Retrieved 23 October 2024.

- ^ "Land of promise". Economist.com. 12 April 2007. Archived from the original on 16 April 2009. Retrieved 15 October 2010.

- ^ Johnson, Steve (11 December 2006). "Emerging Markets: Brics sceptics have their backs to the wall". Financial Times. Archived from the original on 21 May 2015. Retrieved 28 July 2014.

- ^ Prableen Bajpai, CFA (ICFAI) (8 February 2017). "The World's Top 10 Economies". Archived from the original on 11 June 2017. Retrieved 12 June 2017.

- ^ a b "Les « Bric » tiennent leurs promesses" Archived 3 May 2007 at the Wayback Machine, Le Figaro, 23 October 2006 (in French)

- ^ a b "Opinion Page" (PDF). Archived (PDF) from the original on 15 June 2010. Retrieved 15 October 2010.

- ^ Pesek, William (8 December 2005). "South Korea, Another 'BRIC' in Global Wall: William Pesek Jr". Bloomberg. Archived from the original on 16 September 2009. Retrieved 15 October 2010.

- ^ "The Australian Business – Emerging markets put China, India in the shade". Theaustralian.news.com.au. 27 August 2008. Archived from the original on 18 April 2009. Retrieved 15 October 2010.

- ^ Martens, China, "IBM Targets Russian Developers: Could overtake India, China in number of developers, says senior executive" Archived 7 October 2008 at the Wayback Machine , OutSourcing World, 11 February 2006

- ^ "Study: Energy-rich Arab countries are next emerging market". Thestar.com.my. 23 February 2007. Archived from the original on 7 July 2009. Retrieved 15 October 2010.

- ^ "Welcome to Huaye Iron&Steel Group" Archived 27 September 2007 at the Wayback Machine.

- ^ Jim O'Neill (26 August 2010). "How Africa can become the next Bric". Financial Times. Retrieved 19 June 2012.

- ^ "Acronym alert: the Eagles rock, beyondbrics blog". Beyondbrics Blog. 15 November 2010. Archived from the original on 6 April 2012. Retrieved 19 June 2012.

- ^ a b "Our Thinking" (PDF). Goldman Sachs. Archived (PDF) from the original on 13 August 2011. Retrieved 19 June 2012.

- ^ "Correio Da Manha, newspaper". Archived from the original on 28 September 2007. Retrieved 29 November 2008.

- ^ Pal, Mukul (23 April 2007). "Business Standard, "Emerging risk and return"". Business Standard India. Archived from the original on 3 March 2008. Retrieved 29 November 2008.

- ^ "Company News Group, "L'oreal, first quarter sales report"". Archived from the original on 27 September 2007. Retrieved 29 November 2008.

- ^ Martin, Eric (7 August 2012). "Goldman Sachs's MIST Topping BRICs as Smaller Markets Outperform". Bloomberg.com. Retrieved 9 September 2020.

- ^ Spence, Peter (13 October 2014). "Beyond the BRICs: the guide to every emerging market acronym". The Daily Telegraph. Archived from the original on 8 December 2023.

- ^ "'Bric' creator adds newcomers to list". Financial Times.

- ^ Ernesto Gallo; Giovanni Biava (3 April 2013). "After the BRICS, is now time for the MIKT?". Alberto Forchielli. Archived from the original on 22 September 2017. Retrieved 21 September 2017.

- ^ Matthew Boesler (13 November 2013). "The Economist Who Invented The BRICs Just Invented A Whole New Group of Countries: The MINTs". Business Insider. Retrieved 21 September 2017.

- ^ "BRIC thesis Goldman Sachs Investment Bank, "BRIC"" (PDF). Gs.com. Archived from the original (PDF) on 5 March 2006. Retrieved 15 October 2010.

- ^ Global Economics Paper No: 153 The N-11m: More Than an Acronym, 28 March 2007. Archived 11 September 2008 at the Wayback Machine

- ^ "Archived Document" (PDF). Archived from the original (PDF) on 25 February 2009. Retrieved 8 December 2008.

- ^ "Unified Korea to Exceed G7 in 2050". Korea Times. 21 September 2009. Archived from the original on 22 July 2011. Retrieved 15 October 2010.

- ^ Carl B. Haselden Jr. "The Effects of Korean Unification on the US Military Presence in Northeast Asia". Parameters, Vol. 32, 2002. Archived from the original on 28 June 2011. Retrieved 15 October 2010.

- ^ "Global Economics Paper No: 188 "A United Korea?"" (PDF). Archived (PDF) from the original on 14 July 2011. Retrieved 15 October 2010.

Bibliography

[edit]- Elder, Miriam, and Leahy, Joe, et al., Who's who: Bric leaders take their place at the top table, Financial Times, London, 25 September 2008

- Firzli, M. Nicolas, "Forecasting the Future: The BRICs and the China Model", JTW/ USAK Research Center, 9 March 2011

- Kateb, Alexandre, Les nouvelles puissances mondiales. Pourquoi les BRIC changent le monde" (The new global powers. Why the BRIC change the world) (in French), Paris : Ellipses, 2011, 272 p. ISBN 978-2-7298-6473-6

- O'Neill, Jim, BRICs could point the way out of the Economic Mire, Financial Times, London, 23 September 2008, p. 28.

- Mark Kobayashi-Hillary, 'Building a Future with BRICs: The Next Decade for Offshoring' (Nov 2007). ISBN 978-3-540-46453-2.

- James D. Sidaway (2012) 'Geographies of Development: New Maps, New Visions?', The Professional Geographer, 64:1, 49–62.

- J. Vercueil, Les pays émergents. Brésil-Russie-Inde-Chine... Mutations économiques et nouveaux défis (Emerging Countries. Brazil – Russia – India – China... Economic Transformations and new Challenges) (in French), Paris : Bréal, 2010, 207 p. ISBN 978-2-7495-0957-0

- Paulo Borba Casella, "BRIC : Brésil, Russie, Inde, Chine et Afrique du Sud – A l'heure d'un nouvel ordre juridique international", éd. A.Pedone, Paris, Sept. 2011, EAN ISBN 978-2-233-00626-4

External links

[edit]- The Sino-Brazilian Principles in a Latin American and BRICS Context: The Case for Comparative Public Budgeting Legal Research Wisconsin International Law Journal, 13 May 2015

- Centre for Rising Powers, University of Cambridge

- Russian President Putin planning to glue together the most powerful superpower coalition in the world Archived 14 May 2013 at the Wayback Machine

- Putin: The Father of BRIC

- The Creation of Clubs: The BRIC

- Gorbachev, Not O'Neill, Deserves BRIC Credit

- Insights on the Iran deal, BRICS and handling a crisis in Venezuela

- BRICS

- 2000s in economic history

- Economic country classifications

- Multilateral relations of Brazil

- Multilateral relations of China

- Multilateral relations of India

- Multilateral relations of Russia

- Multilateral relations of South Africa

- Brazil–China relations

- Brazil–India relations

- Brazil–Russia relations

- Brazil–South Africa relations

- China–India relations

- China–Russia relations

- China–South Africa relations

- India–Russia relations

- India–South Africa relations

- Russia–South Africa relations